Tips for success in tax season

No matter how long you have been or will be in the industry, tax season will never be described as “easy.” Packing the bulk of the year’s work into a few short months defies all possibility of normalcy in the workplace. The combination of long days, lack of sleep and piles of work takes a toll on even the most put-together accountant

Luckily, you can take measures now to make the rest of the 2019 tax season a more manageable, fulfilling experience. To give you some ideas, 10 of Canopy’s in-house tax professionals shared their tips for tax season success. So, whether you are interested in improving teamwork at your firm, taking better care of your health, or learning about specific tax regulations, keep reading for tips you can implement right away.

Set team expectations early and often: “As I’ve worked with various teams through busy seasons, one of the most valuable things we’ve done was set clear expectations. We meet early in the season to discuss as a group how each member of the team will be allowed enough flexibility to take personal time. For example, the team may decide that on certain days the whole team gets to work from home, or we may choose one night each week for a particular team member to leave the office early. Allowing each team member to retain some personal time is crucial for surviving busy season.

Work smarter, not harder: “It is important as an accountant to take care of your mental health during tax season. Work smarter and more efficiently so that you can be home at least twice a week for dinner with family, or make it a point to treat yourself to a movie. In order to work more efficiently, scrub your calendar. Remove all unnecessary meetings

Don’t forget the new pass-through deduction for business income: “Are any of your clients a sole proprietor, partner, member of an LLC or shareholder of an S corporation? If so, remember to apply pass-through income and they may be able to deduct up to 20 percent of their business income when filing their taxes. Based on the title of the deduction, many people are surprised that sole proprietors filing a Schedule C may be qualified for this tax break. As a tax professional, take extra time to understand the specific rules for this new deduction, so you know exactly how to help clients who are in these situations

steps for first-time tax filers

Filing your federal income tax return can seem overwhelming. But you can tackle tax season one step at a time—and avoid rookie mistakes—while you take advantage of money-saving opportunities.

You need to file a tax return if you meet or surpass certain levels of income during the year. If you’re employed, look at your pay stub for the “year to date” income—and if you have more than one job, be sure to add up your income from all your employers. Remember to include income from other sources, too, such as money you make on rental property, anything you sell, investments or interest

Stay on top of tax-related paperwork throughout the year; it will make your life easier during tax season. You might want to keep receipts for things like charitable donations, work-related expenses and medical bills, or other items from step 4. You may also want to keep statements from student loans or investments and any grants or fellowships. Having these handy and organized can help you determine whether to itemize and make the process easier. You should keep your paperwork after you file, too. The IRS recommends keeping records for at least three years.

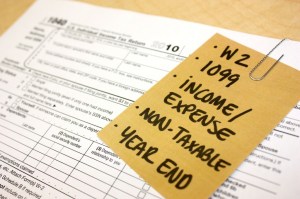

You should receive forms about how much income you’ve earned from your employers and other income sources in January or February. If you are a full-time employee, you will receive a Form W-2 detailing your earnings, as well as which taxes were withheld. If you work freelance or on a contract, you may receive a Form 1099-MISC detailing what you earned. You may also receive documents showing dividends or interest earned on investments (Forms 1099-DIV or 1099-INT, for example), or student loan interest you’ve paid (Form 1098-E). If you’re a college student (or you have a dependent who is), you’ll receive a Form 1098-T that shows how much you paid in tuition, as well as any amounts you received from grants or fellowships, to help you figure out deductions and credits related to education expenses.

Getting a sense of which credits and deductions you may be eligible for can help you pull together the proper documentation. Here are a few to consider:

Saver’s credit. If you are not a full-time student and are not being claimed as a dependent, you may be eligible for a tax credit if you contribute to a retirement plan. The amount of the credit depends on your filing status and adjusted gross income. For the 2020 tax year, If your filing status is single, you may be eligible if your adjusted gross income is $32,500 or less. If you are married and are filing jointly, you may be eligible if your adjusted gross income is $65,000 or less. However, these numbers are subject to change in future tax years.

Student loan interest. You can deduct up to $2,500 in interest payments, depending on your modified adjusted gross income.

Charitable deductions. Donating to your alma mater or a favorite charity? Generally, you can deduct those donations if you itemize your taxes.

Freelance expenses. If you are self-employed, you may be able to claim deductions for work-related expenses such as industry subscriptions and office supplies.

What Do You Need To File Taxes?

Every taxpayer’s situation is unique, and thus it is impossible to list all the items one must bring in for a tax appointment for every type of tax situation. When in doubt, bring the item in question to your tax appointment

Prior Year Tax Return Copies

If you are a new client, please bring copies of your last 3 years federal and state income tax returns. R&G Brenner will review them for FREE, and we may be able to amend mistakes/omissions getting you back additional refunds

Personal & Dependent Information

Social Security or ITIN Numbers with date of births for anyone who’ll be on your tax return

Childcare payment records with licensed provider’s ID number(s)

Amount of any alimony payments with ex-spouse SSN

Income Statements

Bring any & all W-2, 1098, 1099 & schedule K-1 forms

Purchase date & total investment for any stocks or property sold

List of investment related expenses

Education scholarships or fellowships

If you are planning on itemizing your deductions (Schedule A) please compose a spreadsheet/list summarizing them. Itemized deductions include:

Mortgage interest, real estate & personal property tax records

Casualty & theft losses

Amounts of state & local income tax paid in prior years

Records of cash donations to religious institutions, schools & other charities

Records on non-cash charitable donations

Unreimbursed job related expenses (travel, tools, cell phone charges, uniform cost/cleaning, luggage, services fees, trade journals, meals & entertainment)

Job search/moving expenses

Should You Do Your Own Taxes?

Asking someone to do your taxes can be a little like asking for help with home improvement tasks. Some people enjoy do-it-yourself (DIY) projects—they have the knack, and would rather save money and keep their business to themselves. Meanwhile, others are happy to outsource these time-intensive chores to a professional, who may also do a better job.

It’s the same when it comes to preparing your own tax return. Whether you decide to pay someone depends on your confidence in crunching numbers and a basic understanding of tax rules, plus your willingness to put in the time.

Tax Laws in Effect for 2019

You might want to enlist the help of a professional to prepare your 2019 return, even if you consider yourself to be pretty tax-savvy, because the Tax Cuts and Jobs Act (TCJA) made some sweeping changes to the tax code when it went into effect on Jan. 1, 2018.

Standard deductions more or less doubled after the law went into effect, and this might make itemizing less attractive to some taxpayers who have chosen that route in the past, particularly because changes were made to quite a few itemized deductions as well.

The Cost Factor

One nice thing about preparing your tax return yourself is that it can be free. If you are an expert and choose to do it the old-fashioned way with a paper return and a pen, you will pay nothing. Many people also choose DIY tax preparation software through companies like TurboTax or H&R Block, which have very low fees and sometimes free deals. These services usually offer tax support and advice.

The best tax preparation software

Tax preparation software can speed up and simplify the process. But how do you know which product is best for you? NerdWallet, the personal finance website, did a lot of the legwork for you. Evaluations for the Best Tax Software of 2020 were based on features, tools, ease of use, support and price.

Read this before you buy tax prep software

If your adjusted gross income is below $69,000, visit the IRS website and see if you qualify for the Free File Program. Ten major software companies — including TurboTax, H&R Block and TaxAct — are taking part this year.

If you don’t qualify for IRS Free File, then you should look at the free packages available from the tax preparation companies. TurboTax, H&R Block, TaxAct, TaxSlayer and Jackson Hewitt all offer free online preparation and filing for those with simple tax returns.

BEST FOR SIMPLE RETURNS: H&R Block Free Edition

NerdWallet Take: “When it comes to tax prep software that can do simple returns at a reasonable price without sacrificing user-friendliness, we think H&R Block Free stands out from the crowd.”

NerdWallet defines a “simple” return as one that has W-2 wages, limited income from interest or dividends (less than $1,500) and taking the standard deduction.